Demonstration City: Hanoi

Inform

One key stakeholder group for sustainable urban mobility are national and local governments. Together with UNDP, the SOLUTIONSplus team organised a “National Training on E-Mobility” in Hanoi City. The objective was to support the Vietnamese government in integrating e-mobility into the city development plan and to implement mitigation measures from the transport sector noted in Vietnam’s Nationally Determined Contributions (NDC). Topics of the training comprised policy instruments to promote e-mobility, technical infrastructure including battery swapping systems, and the integration of shared mobility offers with collective transport systems.

Hanoi stakeholders benefited from the knowledge products related to the demonstration activities and e-mobility in a local context, such as shared mobility systems, charging infrastructure, and vehicle integration services, that were incorporated in the SOLUTIONS- plus online toolbox. Stakeholders from Hanoi joined the Asian regional and Hanoi-specific trainings on e-mobility over the entire project lifetime.

Inspire

In May 2021, a first regional training for Asian cities was conducted, focusing on the contribution of e-mobility and integrated urban mobility planning to achieving the SDGs in Asian cities. Due to travel restrictions, the training was held online. The subsequent, 2nd Asia Regional training in October 2021 consisted of 3 modules:

Module 1 provided introductory knowledge about the e-mobility ecosystem and synergies/policy integration with other local concerns, including energy efficiency and conservation, air quality, and public health. Module 2 dived into policies and regulations to promote e-mobility, and Module 3 focused on setting up charging infrastructure, including different kinds of charging, standards and specifications, and operation models.

A Hanoi City training was held in November 2022 as a 2-days event in Vietnamese language. Topic areas covered the planning and implementation of low emission zones, the implementation, operation, and maintenance of electric vehicles, and planning for electric vehicle infrastructure. Contributions focused on the role of national and local administrations in promoting e-vehicles; on the opportunities and barriers of infrastructure development in Vietnam and Hanoi city; on identifying the key stakeholders of the e-vehicle ecosystem; on technical standards for vehicles and charging infrastructure; and on financing mechanisms for the replacement of ICE vehicles with electric counterparts. Finally, experts provided insights into the development emission reduction scenarios and assessments.

In November 2022, a 2-day national training on e-mobility was organised in Hanoi jointly with UNDP. Various national and inter- national experts discussed local and international experiences on integrating e-mobility into planning, technical details on electric vehicles and charging infrastructure. Representatives from local government, academia and private sectors actively participated in the training.

The SOLUTIONSplus team organised an international training on advancing electric two-wheeler initiatives in Hanoi in April 2024. The workshop focused on shared electric vehicles in Hanoi: its current status, needs, barriers and opportunities; the legal framework, institutions and operating models; the integration of Mobility-as-a-Service into the collective transport system; on gender mainstreaming in the transition to electric transportation in Vietnam; and on a setting up a Monitoring Reporting and Verification (MRV) framework for electric two-wheelers. The set of participants comprised representatives of the national government, representatives of the Hanoi City People’s Committee and administrative departments (Transport, Infrastructure, Environment, Industry and Trade, Finance), national and international experts and scientists, UN institutions, and development cooperation.

Hanoi stakeholders benefitted from several peer-to-peer exchanges and trainings on E-buses (organised by UITP in Kuala Lumpur, Malaysia), on electric two- and three- wheelers (organised by UNEP in Bangkok, Thailand), on e-mobility session at the Better Air Quality conference (organized by CAA in Manila, the Philippines), and on Decarbonising transport in India and the region, (organised by ITF and WI in 2024). In the context of SOLUTIONSplus, Hanoi stakeholders participated in site-visits to Hamburger Hochbahn AG (2022), EMT Madrid (2023) and Kuala Lumpur E-BRT (2023), showcasing e-buses and other e-mobility options.

Initiate

A local start-up, QiQ Elevate Mobility, was initially charged with implementing and operating the shared e2-wheeler system in Hanoi. This included the development of an app for booking and returning vehicles and for monitoring battery status.

However, as QiQ was unable to fulfil its commitment to deliver the V-Share software prior to the deployment of the pilot, the team relied on Google Forms and UTT’s IOT as an alternative. This alternative enables users with to register for an account, borrow and return vehicles, as well as supporting the operating, monitoring process of the system and store user information

The German start-up Betteries (selected through the EU-Innovators call) provided a mobile charging unit, which was installed at a docking station. The BetterGen system uses second life batteries, which can be deployed as vehicle battery or provide intermittent battery storage capacity for vehicle charging hubs. The local SOLUTIONSplus partner, University of Transport Technology (UTT), is in close collaboration with UNEP for implementing a similar shared e-2-wheeler system in Hanoi and for expanding the services.

Implement

The Hanoi demonstration activity connects the AEON shopping mall with a BRT station in a distance of 2 kms. The shared e-mobility system consists of 50 electric mopeds and was launched n November 2022.

The main activities carried out in Hanoi comprised:

E-moped scooters for last mile connectivity:

Fifty units of e-mopeds (Vinfast Ludo) were procured and operated to provide last mile services. In order to gain the permission to operate a shared e-mobility system, UTT carried out several meetings with local authorities. An approval from Hanoi People’s Committee has been obtained. A dedicated E-2 wheelers parking hub has been set up. To ensure drivers’ safety, helmets are provided in each e-mopeds and insurance documents (vehicle owner’s liability insurance and accident insurance for passengers) were prepared. A trial operation of the e-moped took place prior to demo launch.

App and IoT:

During the six months pilot period, the team utilised Google Forms and UTT’s IOT. This enabled users to register for an account, and to to borrow and return vehicle. Operators used the software to monitor process and to store user information. The data on the pilot period was used to understand user flows, their demand and operation pattern. The Battery Management System (BMS) controls in real time parameters such as temperature and voltage and switches off the system if some of the cells exceeds the values pre-defined as safety limits. The data collection on the charging unit performance was carried out.

BetterGen charging: The BetterGen charging unit from Betteries was installed at Aeon mall. The charging unit was with a 220V, 50Hz power source (the AC Dock has 3 BetterPacks installed). Outside the operating hours (from 9pm to 9am) the e-scooters and the charging system are locked.

Master plan for shared two-wheeler stations: To support Hanoi City in developing and scaling up shared e-two wheeler systems, UTT developed a master plan and a detailed study of shared two-wheeler stations in 10 districts in Hanoi.

Preliminary Results

Final Results

Impact

The impact assessment concluded that shared e-mopeds can contribute to reducing emissions of greenhouse gases and air pollutants. SOLUTIONSplus organised a workshop on 28th November 2022 to carry out the impact assessment of the shared e-2 wheelers demonstration actions in Hanoi. Ten key local stakeholders joined the workshop and discussed the priority indicators. Along with this, a scale-up concept note is being developed to improve ridership and to expand the services to another route. A policy paper on e-two-wheeler sharing systems in Hanoi is currently being prepared, considering barriers, opportunities and policy recommendations for a successful planning process.

Replication

Along with the impact assessment, SOLUTIONSplus developed a scale-up concept to increase ridership and to expand the services to additional routes. A policy paper on e-two-wheeler sharing systems in Hanoi is currently being prepared, considering barriers, opportunities and policy recommendations for a successful planning process.

Achievements in Hanoi

In Hanoi, significant achievements in advancing e-mobility were achieved through targeted initiatives and collaborative efforts. Stakeholders gained essential knowledge through SOLUTIONSplus online electric mobility platforms and various regional and international electric mobility capacity building activities, enhancing their understanding of electric mobility technicalities and policy frameworks. The successful implementation of a shared electric two wheeler system, and development of a policy advice paper to support on scaling it up as well as a master plan for shared two-wheeler stations underscored Hanoi’s commitment to sustainable transportation solutions.

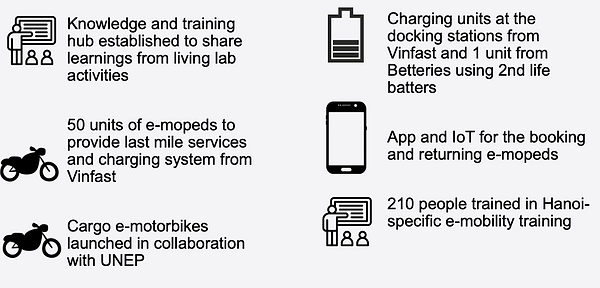

2 on-site e-mobility trainings conducted in Hanoi. • Approximately 150 individuals trained on-site, with around 65 being women. • 1 online electric mobility training session conducted, with approximately 100 participants, including 30 women. • Data collection carried out on the six-month demo period and BetterGen charging unit performance. • Launch of a pilot shared e-mobility system with 50 electric mopeds in Hanoi. • Utilization of Google Forms and UTT’s IoT for smooth operation and data collection during the pilot period. • Installation of BetterGen charging units at strategic locations, such as Aeon mall. • Development of a master plan for shared two-wheeler stations in 10 central districts of Hanoi. • Impact assessment workshop held to evaluate the shared electric 2-wheelers demonstration actions. • Preparation of a scale-up concept note and policy paper for the sustainable integration of e-mobility in Hanoi.

Trends and Drivers

Overarching issues

Vietnam is experiencing rapid economic growth (6% per annum) and urbanization, which is also coupled by a rapid increase in transport demand. Study estimates that if policy measures are not implemented, the GHG emissions from the transport sector will triple by 2030, from the current level of 32 million tons Carbon dioxide equivalent (CO2e) per annum. The International Energy Agency (IEA, 2018) estimates that 97% of the transportation GHG emissions are from road vehicles. Essentially, road vehicles contribute 18.5% of the total fuel combustion-related GHG emissions in Vietnam. The per capita CO2e emissions from transportation is estimated to be 350 kg/year (IEA, 2018). Transportation has also been implicated as a major source of urban air pollution in Hanoi (Clean Air Initiative, 2010).

In 2017, there were 54 million registered motorcycles, 1.5 million cars, 154 thousand trucks, and 1.1 million trucks in Vietnam. From 2007 to 2017, passenger car registration has been growing at a rapid pace of 17% per annum, while motorcycle registration has grown at 10%. The bus fleet is growing by 6% per year, and trucks by 14% per year based on the data collected by the ASEAN-Japan Transport Partnership (AJTP, n.d.). About 96% of the motorbikes in Vietnam belong to the following brands: Honda, Yamaba, Suzuki, Piaggio (Ha, 2017).

E-mobility overview

The uptake of e-mobility has been slow in Vietnam. According to the VIR (2018, as quoted in Pastoor 2019), only 1,229 hybrid vehicles and 7 electric vehicles (excluding 2-wheelers) have been shipped to Vietnam from January 2010 and March 2017. The MoT’s five-year plan aims to introduce 200 hybrid and 50 plug-in hybrid buses by 2020. It is interesting to note that there is a dedicated unit focusing on e-mobility within the MoT’s Department of Environment (Bakker et al., 2017).

Honda, which currently dominates the motorcycle market (74% in the first 9 months of 2018), recently launched a hybrid model called PCX (“E-bike brands“, 2018). Electric bikes from China are also imported and sold for 1,500 to 1,950 USD. There are also locally produced EVs such as Pega Aura (fitted with Bosch technology) which sell for approximately 630 USD (“E-bike brands“,). VinFast (see section 3.E) is aiming to capture a significant portion of the local market, as it opens its manufacturing facility in Haiphong. VinFast aims to produce 250,000 motorbikes within a year. Together with the launching of its manufacturing facility, it also launched its electric motorbike model called Klara which retails for 913 USD (lead-acid) to 1,521 USD (lithium ion) (“E-bike brands“, 2018). VinFast is also cooperating with PV Oil to put up 30,000-50,000 charging stations and battery leasing terminals throughout the country (Pastoor, 2019).

Current state and initiatives

Currently, the local capacity for EV manufacturing, operation and maintenance is limited in Hanoi. There is no organisation that provides courses on EVs yet. Universities in Hanoi do not have formal degree courses in EVs yet but EV is partly included in engineering degrees (e.g. Automotive engineering). University of Transport Technology (UTT) and other universities in Hanoi are highly interested to collaborate to start with organizing courses (including e-courses) on EVs and organizing workshops targeting different stakeholders.

Vehicle integration

The integration of shared e-scooters with buses and metros can result in easy route planning and payment through the Mobility-as-a-Service app. Existing apps are available for individual mode (e.g. Timbuyt for buses) while previous pilot projects on smart ticketing ended without further implementation (e.g. e-ticket system by Transerco with Viettel Group and MK Ticket Group). Under the SOLUTIONSplus, it is necessary to understand the functionality of the currently active application as well as lessons from the failed vehicle integration project and then develop appropriate Mobility-as-a-Service application for Hanoi city.

Charging infrastructure planning and technology

For the growing number of EVs in Hanoi, mainly Vinfast e-2 wheelers, a support on appropriate battery solutions, disposal and charging options are required. Some solutions have been explored in individual e-scooter and under SOLUTIONSplus suitable options for a shared system are needed. EV charging stations for public transport (E-buses) are limited in Hanoi. Besides a demo of ABB charging solutions in Vinfast E-buses, Hanoi city needs support on charging infrastructure planning and technology.

Business model development

EV is still too expensive compared to conventional vehicles for most of the Vietnamese population. The demo on a shared e-scooter system needs a good business case with the involvement of various stakeholders. Support on business model development on shared e-scooter is a need.

EV promotion

Vietnam/Hanoi has a potential of the EV market due to increasing imports as well as local production (Vinfast). Along with appropriate regulations and financial incentives, Hanoi needs supporting policies on communication, advocacy and promotion of EVs. A strategic planning on capacity building activities for various stakeholders on EV promotion is highly desirable. This can include disseminate cost-benefit analysis and reduced life-cycle cost , that shows market potential, environmental and health benefits.